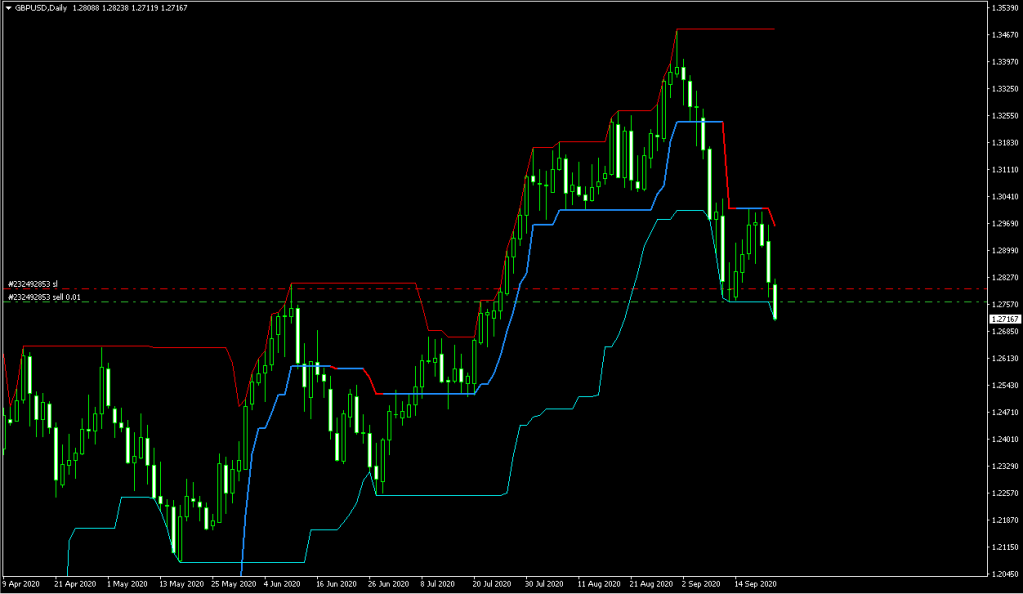

I keep shorting it…..and it keeps going down! Its primary trend is down(in Daily chart)…..So,better to take only shorting trades!

I keep shorting it…..and it keeps going down! Its primary trend is down(in Daily chart)…..So,better to take only shorting trades!

My checklist for the trading psychology! I use the following to check out my own psychology and the psychology of the market,when I try to enter or exit a market,and when I check out the charts. For example,the “Hindsight Bias” is an amazing psychological issue that all chartists suffer from(including myself).

I find the following biases quite helpful in my own trading. So,I just memorized them with the help of ‘mnemonics’. There are other psychological biases too,which I want to memorize in future……

The biases:

Below is the list of patterns,rules(or whatever you call them) that I follow or check before I enter the market or a stock……The mnemonics that I use also has been included:

I call them my ‘checklist for trading”! I don’t think,one can do well in trading(or anything else in life),if one doesn’t have ‘pre-defined’ rules for trading!! A trader without pre-defined,tested rules is a novice,confused,indiscipline trader. It doesn’t matter how long the trader is trading in the market,if he doesn’t know his ‘rules’ of trading well,he is just fucked!

I have kept the ‘mnemonics’ with the rules. These mnemonics are what make me easily recall hundreds of different techniques,rules,ideas or trading experiences I have from real trading……

The patterns:

Here are other related articles:

Here is another of my somatic trade! There was no exit signal in the index. Still,I exited! There were of course two specific reasons for me to exit,which I pointed in the blog post of mine>>>> I locked profit

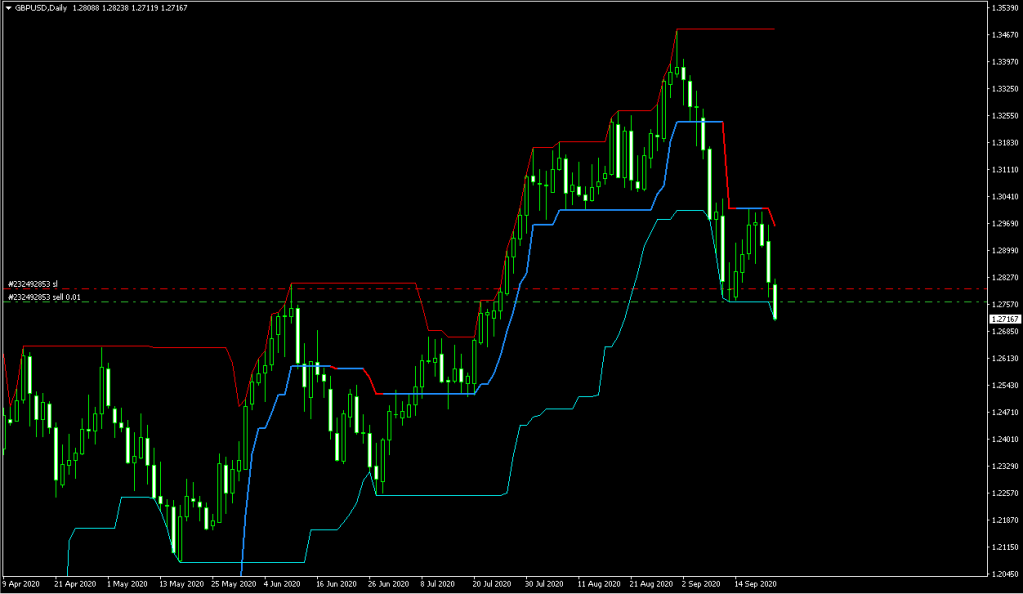

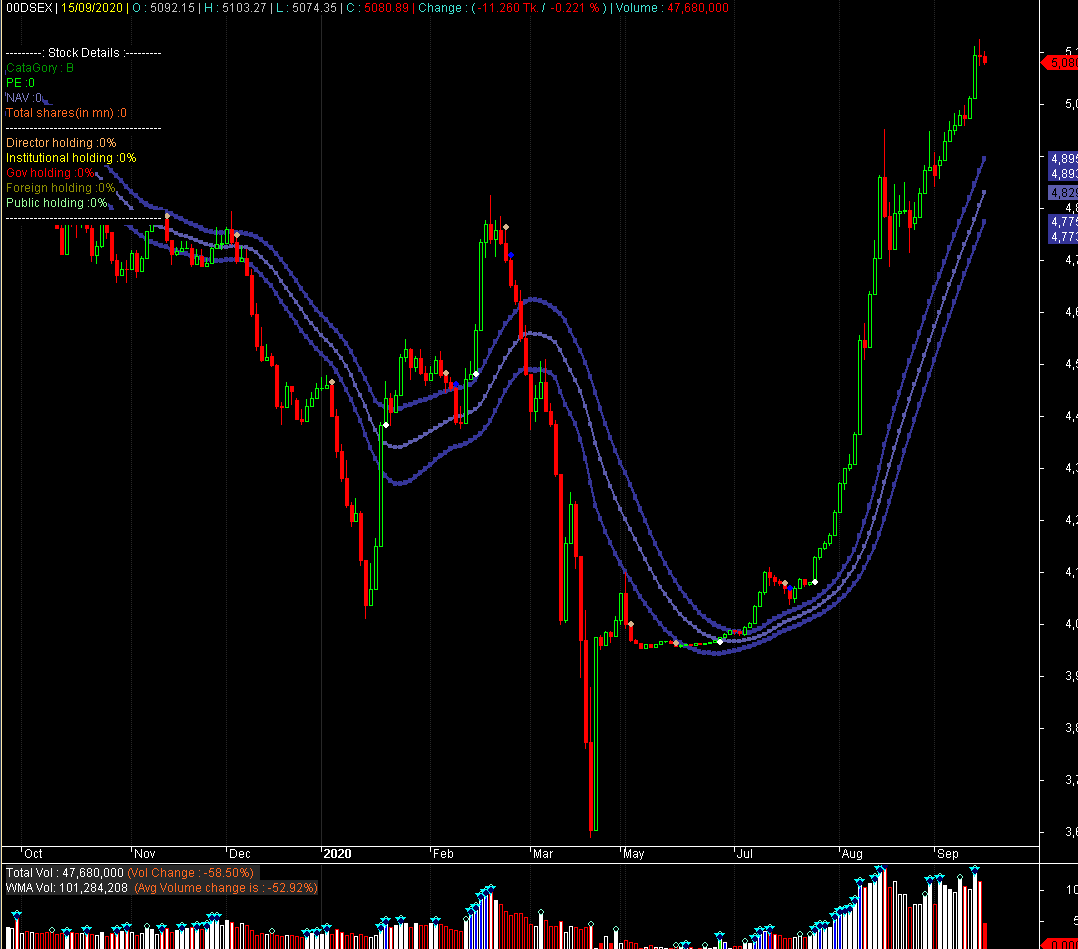

But why in that specific day/time? On 14/09/2020,I exited!The reason lies in the chart—-I unconsciously detected “Herd Mentally” in me and in the market traders! That very high volume and candle day at the top of market on 13/09/2020 showed “something is not right’,as that high volume showed ‘herd’ is entering in the market. That means,it is time to exit!It is how you trade again the ‘herd'(those fucked up,crap traders) makes you or breaks you as a trader!If the herd is too excited and buy at the top,we can expect a correction may be coming….If the herd is too scared and avoid the market at the bottom,we can expect a rise may be coming….

What is strange is,you won’t be able to track the ‘herd’ in the chart all the times. Rather,it is your own somatic feeling that will be able to tell you about the ‘herd’ mentality in the market. You need to sync your own feeling with the herd and the chart,and see if there is any discrepancies detected! Crazy!!

So,what is the future of index now? Who knows!! It could be that we may see a small pullback and then rise in index again………..Or,index could correct a lot more…..Doesn’t really matter. Prediction is rubbish. We will know what we have to do when the right time comes! No need for prediction!

I have known about ‘mnemonic’ techniques since 2015,but I have been implementing mnemonic techniques seriously since 2018! And I love mnemonic techniques. It has helped me in every aspect of life.

I am implementing “mnemonics” techniques in my trading for last couple of months with great success. So,I thought,I would share some ideas on how I apply mnemonics in trading here. Even though stock and currency market are very big and complex, I did not get any articles in the net that discusses how we can implement mnemonic techniques in our stock and currency trading.

Trading is a very very complex thing,especially as it deals with unpredictability of future,which brain has a very hard time to make sense of….

Even though I have been able to make consistent profits in stock market,I had not been satisfied with the way I organize,manage and apply my trading stuffs,trading knowledge,experiences,etc in trading.

For example,I write blogs,personal trading journals(evernote,notion,etc) on my trading quite frequently. But when I need a very specific information on an important trade that I executed in past,I have to search my journals pages. I have to look for how I reacted to certain patterns of the stock and what happened later,etc. This is not an efficient way,as I have to take very very fast decision during ‘live trade’. I have to keep the most important details in my memory so I can access them anytime I want during trading.

Besides,as “Zettelkasten Method” rightly suggests,just by writing and storing journals,articles,we cannot develop knowledge on a subject. We need to evaluate,analyse and connect the valid and related articles and ideas to one another! And I think,with Memory Palace,I can do just that in my trading.

So,I have decided to keep all of my important trading stuffs in my head with the help of mnemonics.

There are three areas that I work on everyday for my trading in stocks or currency. They are:

I will be writing on how I use mnemonic techniques for each of these subject.

Other related Articles on this:

I sold off 80% of my hold of shares today and locked in profit.

There is however no strong exit signal yet in index! Still,I locked in profit! Why?

Because I got 20% profit in my portfolio! It is enough for me for now,so I wanted to lock in the profit.

Secondly,I avoid trading after mid September in the market(till october)!

BUT if I see ‘nice setups’ in a stock or a pullback in index/overall market, I would re-enter the market…….

It is never possible to catch the ‘bottom and top’ of the market! So,it is ok to miss some up moves! 🙂

For now,I’m happy with the profit I got from the market…..

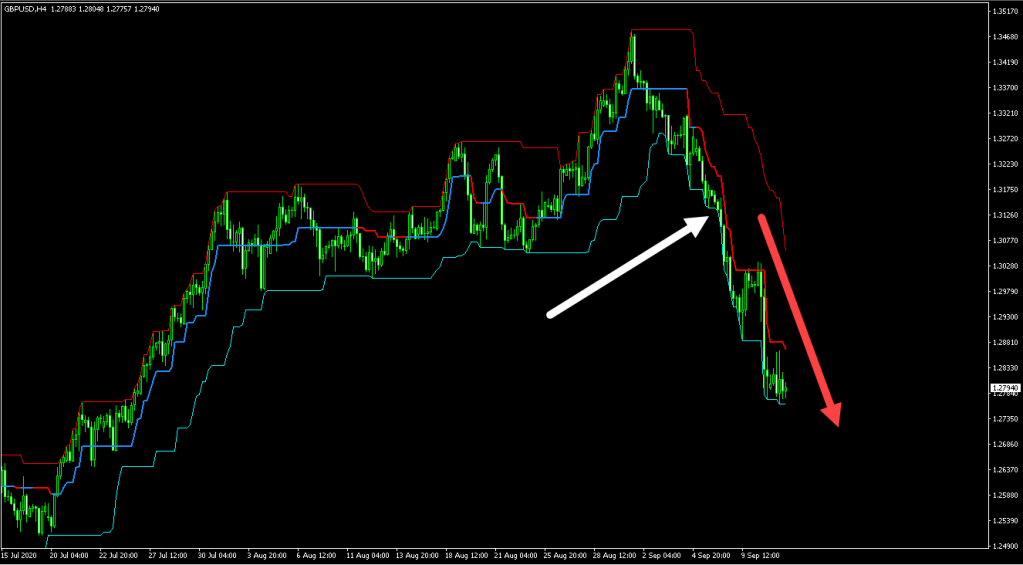

It kept falling and falling! It didn’t even stop at the support levels(white Arrow) that I thought it would pause at….!! It broke down and kept falling! Pretty crazy! Gained big points by shorting!

The reversal is not confirmed yet! It is just consolidating now! Let’s see if it breaks down or break up! 🙂

Nothing in this world is so fucking addictive like Forex trading!!! GBPUSD is shorted since 02/09/2020 and it is still in downtrend!!! I’m expecting a reversal soon. It seems to be reaching to its bottom level,to an important support level….Let’s see what it does..

I love trading!!!! 🙂

TRADING IS SO EASY IF YOU KNOW HOW 😀

Still holding GP, BRAC! Not only I am holding them,I also have added more shares of these two stocks to my portfolio!!

I also bought DBBL last trading day due to a nice “Build Up” pattern. I like this type of “Build Up” patterns. I am adding DBBL to my existing holds of DBBL shares. Let’s see how it moves.

Such a nice and tradable pattern of DBBL. I will be adding more and more shares of DBBL to my portfolio……Very lovely pattern!